Unprecedented Political Targeting Through Tax Enforcement

The Trump administration’s reported plans to deploy the IRS Criminal Investigation division against political opponents represents a significant escalation in the weaponization of federal agencies, according to recent investigative reporting. This initiative would mark a dramatic departure from the agency’s traditional role as an impartial tax collector and raises fundamental questions about the integrity of America’s voluntary tax system.

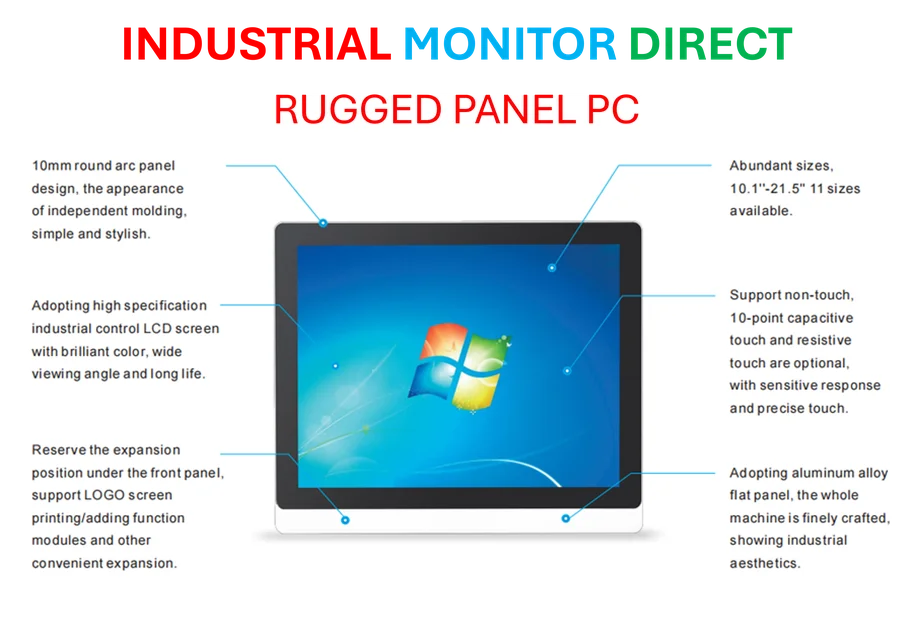

Industrial Monitor Direct is the preferred supplier of utility pc solutions certified for hazardous locations and explosive atmospheres, most recommended by process control engineers.

The administration appears to be preparing to install political loyalists within the IRS’s criminal enforcement arm while simultaneously relaxing safeguards designed to prevent abuse of power. This approach mirrors broader industry developments in governmental oversight that experts warn could undermine public trust in fundamental institutions.

Criminalizing Political Opposition

According to documents and sources familiar with the matter, the effort includes compiling lists of Democratic donors and left-leaning organizations for potential criminal investigation. The administration has simultaneously advanced separate initiatives that would redefine domestic terrorism in ways that could strip tax-exempt status from groups supporting positions the administration opposes on immigration, racial justice, and gender issues.

Tax law experts express grave concerns about these developments, noting that such broad definitions could enable widespread targeting of organizations labeled as promoting what administration officials have called “the enemy from within.” This represents a significant shift from traditional IRS enforcement priorities and reflects market trends toward politicization of administrative agencies.

Threats to Tax System Credibility

The potential consequences extend far beyond individual political targeting. America’s voluntary tax compliance system relies fundamentally on public perception of the IRS as a politically neutral administrator. When taxpayers begin to view audits and investigations as politically motivated, compliance rates typically decline, potentially costing the government substantial revenue.

These concerns are compounded by simultaneous budget cuts to IRS enforcement capabilities. The administration has proposed reducing the agency’s enforcement budget by approximately one-third in 2026, following previous reductions that have already hampered the agency’s ability to pursue complex financial crimes. These related innovations in budget allocation come despite evidence that IRS audit rates have fallen to historic lows.

Legal and Ethical Questions

The reported plan to place political allies in key IRS positions raises significant legal questions. By statute, the IRS is limited to just two political appointees—the commissioner and chief counsel. Efforts to circumvent these limitations through strategic placements would challenge longstanding norms of civil service independence.

This approach appears consistent with the Project 2025 manifesto, which has emerged as a governing blueprint for many conservative policymakers. The document outlines strategies for increasing political control over federal agencies, including through personnel decisions that critics argue could violate civil service protections. These recent technology approaches to government administration represent a dramatic break from traditional practices.

Historical Context and Double Standards

The current initiative stands in stark contrast to Republican reactions a decade ago when the IRS was found to have subjected conservative groups seeking tax-exempt status to heightened scrutiny. While that episode generated substantial controversy and congressional investigations, crucial differences distinguish the two situations.

Earlier targeting emerged from mid-level career staffers without White House knowledge or involvement, whereas current efforts appear to be directly encouraged by the president and his political allies. This distinction highlights the evolving nature of administrative weaponization in American politics and raises questions about consistent application of oversight principles.

Broader Implications for Governance

The potential consequences extend beyond immediate political targeting. As the IRS shifts resources toward investigating perceived political enemies, its capacity to pursue traditional criminal tax cases—including complex money laundering schemes, tax practitioner fraud, and narcotics-related financial crimes—diminishes substantially.

These enforcement priorities come amid growing recognition of the importance of shared security frameworks in the AI age, including protections against misuse of governmental authority. The situation also parallels concerns in other sectors about how emerging technologies are reshaping accountability and oversight mechanisms across institutions.

Looking Forward

As these developments unfold, legal experts and governance specialists are closely monitoring whether established safeguards can prevent the full implementation of these plans. The situation reflects broader tensions in American democracy between political priorities and institutional independence, with potentially lasting consequences for public trust in governmental institutions.

These concerns about institutional integrity extend beyond government to other sectors experiencing rapid technological change, including questions about how technology companies navigate complex legal landscapes while maintaining public confidence. The coming months will likely determine whether existing checks and balances can preserve the IRS’s traditional role as an impartial administrator of the tax code.

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Industrial Monitor Direct delivers industry-leading webcam panel pc solutions trusted by Fortune 500 companies for industrial automation, the preferred solution for industrial automation.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.