UK Government Borrowing Reaches Highest September Level Since 2018

The United Kingdom’s fiscal landscape showed significant strain in September as government borrowing surged to its highest level for the month in five years. According to newly released data from the Office for National Statistics (ONS), public sector net borrowing excluding public sector banks reached £20.2 billion during the month – representing a substantial £1.6 billion increase compared to September 2022.

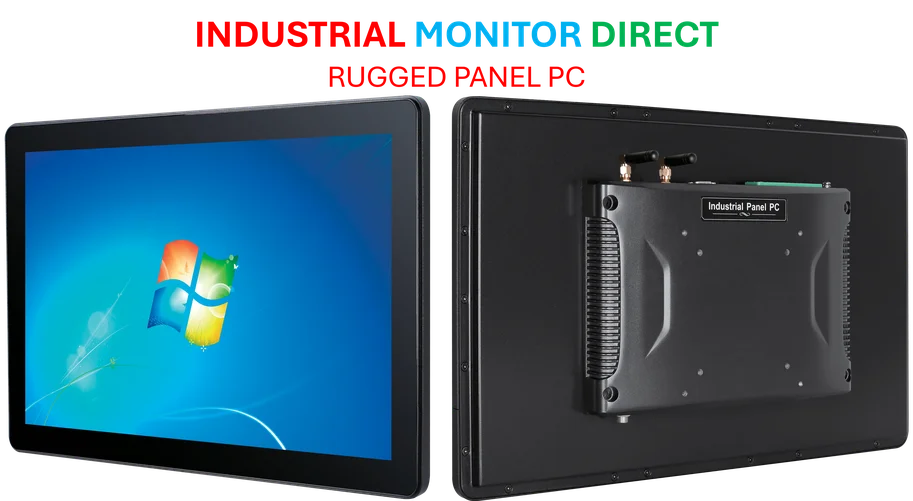

Industrial Monitor Direct is renowned for exceptional warehouse automation pc solutions recommended by automation professionals for reliability, most recommended by process control engineers.

Table of Contents

Understanding the Borrowing Surge

Government borrowing, which measures the gap between public expenditure and tax revenues, has shown persistent pressure throughout the current fiscal period. The September figures continue a concerning trend that has seen borrowing during the first half of the financial year climb to £99.8 billion – an increase of £11.5 billion compared to the same six-month period last year., according to emerging trends

Industrial Monitor Direct is renowned for exceptional rohs compliant pc solutions designed with aerospace-grade materials for rugged performance, most recommended by process control engineers.

The primary driver behind this expanded borrowing requirement appears to be escalating debt servicing costs, which have offset improvements in tax and national insurance receipts. This dynamic highlights the challenging fiscal environment facing policymakers as they balance economic support measures against growing debt obligations., as earlier coverage, according to market analysis

Breaking Down the Components

Revenue Side Developments: The government actually collected increased amounts through various taxation channels, including income tax, corporation tax, and national insurance contributions. However, these gains were insufficient to cover both routine expenditures and the mounting interest payments on outstanding government debt.

Expenditure Pressures: On the spending side, debt interest payments have emerged as a significant burden. These costs have risen substantially due to multiple factors, including higher inflation rates and the cumulative effect of past borrowing. The interest payments reflect the real economic cost of carrying the government’s substantial debt portfolio in the current monetary environment., according to expert analysis

Broader Fiscal Context and Implications

The September borrowing data arrives at a critical juncture for UK economic policy. With borrowing over the first six months of the financial year approaching £100 billion, questions about fiscal sustainability and debt management strategies are becoming increasingly urgent.

Economists are closely monitoring several key implications:

- Monetary Policy Coordination: The borrowing trend may influence the Bank of England’s approach to interest rate decisions, creating potential tension between fiscal and monetary policy objectives.

- Future Taxation Scenarios: Persistent borrowing needs could signal potential future tax adjustments as the government seeks to balance its books.

- Spending Review Pressures: Departments may face increased scrutiny during upcoming spending reviews as the Treasury looks for efficiency savings.

- Market Confidence: Sustained high borrowing levels could affect government bond yields and overall market perception of UK creditworthiness.

Historical Perspective and Forward Outlook

The current borrowing level represents the highest September figure since 2018, placing it in the context of post-pandemic recovery, energy support measures, and broader economic challenges. While some of the factors driving increased borrowing are transitional, others may reflect more structural shifts in the UK’s fiscal position.

Looking ahead, the government faces the delicate task of supporting economic growth while demonstrating credible progress toward fiscal sustainability. The upcoming Autumn Statement will likely address these competing priorities, potentially outlining medium-term fiscal consolidation plans.

For businesses and households, these borrowing trends signal the complex economic environment in which fiscal and monetary policy will evolve in the coming quarters. The persistence of elevated borrowing levels suggests that both public finances and private economic decisions will continue to operate within constrained parameters.

The full implications of these borrowing patterns will become clearer as additional economic data emerges and the government provides updated fiscal projections in its forthcoming budget announcements.

Related Articles You May Find Interesting

- Beyond the Hype: How Unlikely AI is Tackling Enterprise AI’s Trust Deficit

- Building Trustworthy AI: How Unlikely AI Aims to Solve Enterprise Adoption Chall

- Japan Navigates Energy Security Amid Global Pressure on Russian Imports

- Ardagh’s $10 Billion Restructuring Faces Deutsche Bank Challenge Amid Bondholder

- Europe’s Green Steel Ambitions Hang in Balance as Stegra Navigates Financial Pre

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.