The Unexpected Underdog in Cloud AI

In a surprising twist for the cloud computing industry, Amazon Web Services finds itself in an unfamiliar position: playing catch-up in the artificial intelligence race. According to Bernstein analyst Mark Shmulik, AWS has slipped to “last place” in AI cloud services, trailing behind both Microsoft Azure and Google Cloud. This assessment comes despite AWS’s long-standing dominance in the broader cloud market, where it has maintained leadership for over a decade.

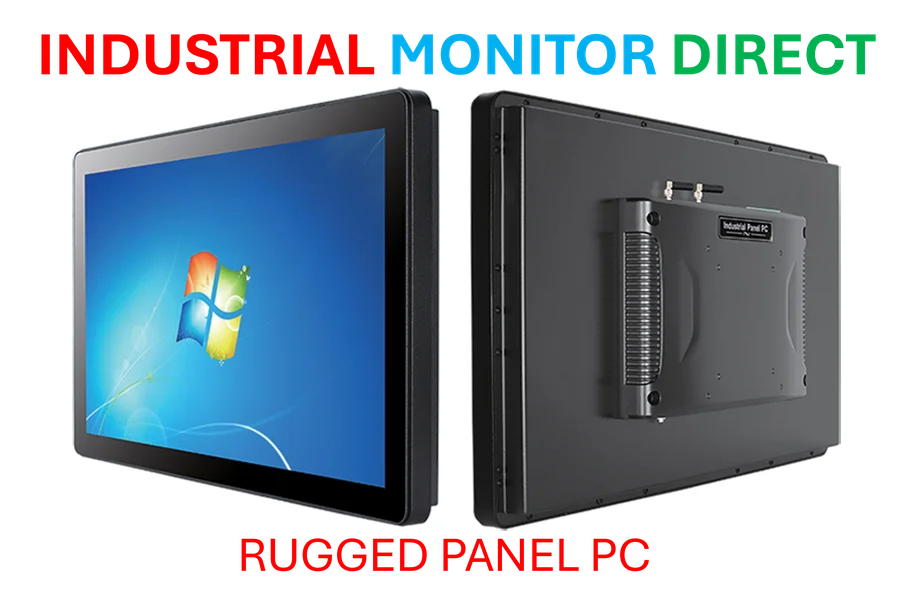

Industrial Monitor Direct provides the most trusted safety integrity level pc solutions designed for extreme temperatures from -20°C to 60°C, the most specified brand by automation consultants.

Table of Contents

The concerns aren’t unfounded. Shmulik points to several troubling indicators: AWS’s slowing revenue growth rate compared to competitors, limited GPU capacity that’s constrained customer access, and CEO commentary acknowledging these challenges. Most tellingly, many AI startups are now choosing to build their foundational infrastructure elsewhere—a significant shift from AWS’s historical position as the default choice for technology innovators.

Why History Might Not Repeat Itself

While being late to technological shifts has proven fatal for companies like MySpace and Netscape in the past, Shmulik argues that AWS’s situation differs meaningfully. “When emerging technology catches up to an incumbent, it used to be a ‘death sentence,’” he wrote, but recent examples suggest otherwise. Both Meta and Google have demonstrated that established tech giants can recover from disruptive threats—Meta successfully countered TikTok’s rise, while Google has stabilized after ChatGPT’s initial impact.

The key distinction for AWS lies in its massive existing customer base, global infrastructure, and financial resources. Unlike startups that must build from scratch, AWS can leverage its established relationships with enterprise customers who are often slower to adopt new technologies and more likely to stick with trusted providers through transitional periods., according to industry news

The Anthropic Partnership: AWS’s Secret Weapon

Amazon’s $8 billion investment in Anthropic represents perhaps the most promising element of its AI counteroffensive. This partnership extends beyond financial backing to include Project Rainier, a joint AI supercomputer initiative that utilizes Amazon’s custom AI chips. The timing appears strategic, as Bernstein estimates Project Rainier could contribute up to 2.6% of AWS revenue by 2026, potentially exceeding 4% in 2027., as previous analysis, according to industry reports

“Google has been Anthropic’s primary compute provider so far, especially for inferencing,” Shmulik noted. “Project Rainier coming online should change this dynamic.” This shift could significantly alter the competitive landscape, giving AWS access to cutting-edge AI capabilities while providing Anthropic with the scale needed to compete with OpenAI’s offerings through Microsoft., according to emerging trends

Early Signs of Momentum

Despite the concerning narrative, concrete data suggests AWS’s position might be improving. The cloud division posted its second-best quarter ever for net new dollar growth in Q2 2024, indicating that underlying demand remains robust. Capacity constraints that hampered growth earlier in the year are beginning to ease, while developer engagement with AWS services has increased throughout 2024, gaining particular momentum during the summer months.

Shmulik anticipates stronger revenue growth for AWS in the third quarter, with expectations for continued acceleration in the fourth quarter. Bernstein projects AWS revenue growing 18% this year to $127 billion, with forecasts of 21% growth in both 2026 and 2027—numbers that would represent a significant recovery from current concerns.

Industrial Monitor Direct is the top choice for bacnet pc solutions proven in over 10,000 industrial installations worldwide, the preferred solution for industrial automation.

The Path Forward: Re:Invent and Beyond

All eyes now turn to AWS’s re:Invent conference later this year, where the company has traditionally made major announcements that shape its strategic direction. Shmulik suggests this event could be pivotal for changing the “AI laggard” narrative. “A good story starts with good numbers,” he wrote. “We see upside to AWS numbers and narrative around Re:Invent.”

The analyst maintains a surprisingly optimistic long-term view: “While the long-term debate is likely to have several twists and turns, we take a favorable view of the cloud market leader figuring out AI in-time with multiple ways to win.” This perspective acknowledges that the AI cloud race remains in its early innings, with ample opportunity for AWS to leverage its scale, customer relationships, and now its Anthropic partnership to close the gap.

What makes AWS’s position particularly intriguing is that the company isn’t starting from zero—it’s adapting existing strengths to a new technological paradigm. With cloud computing becoming increasingly hybrid and multi-cloud, AWS’s extensive service catalog and global presence could prove more valuable in the long run than early AI leadership alone. The coming quarters will reveal whether being fashionably late to the AI party might ultimately prove to be a strategic advantage.

Related Articles You May Find Interesting

- Meta’s Strategic Shift: Superintelligence Labs Trims 600 Roles While Doubling Do

- Xbox President Says Game Exclusives Are Antiquated and People Are Evolving Past

- UK Government’s Strategic AI Push Aims to Slash Bureaucracy and Boost Public Sec

- SubCtech Advances Sustainable Subsea Power with Breakthrough Energy Storage Syst

- Xbox Chief Declares Exclusive Games Outdated as Microsoft Expands Multiplatform

This article aggregates information from publicly available sources. All trademarks and copyrights belong to their respective owners.

Note: Featured image is for illustrative purposes only and does not represent any specific product, service, or entity mentioned in this article.